Three leading Hungarian fintech companies, Cellum, Cardnet and Festipay are working with MasterCard on an exciting project that could be as revolutionary within the payment market as smartphones in mobile telephony.

During these unusual times, the widespread acceptance of contactless payment options is particularly important and is becoming actively encouraged. Bank coins and notes passing through many hands can easily become an innocent yet uncontrolled carrier of viruses and bacteria. Pin entry pads such as those found on ATMs or POS terminals can also inadvertently retain bacteria and viruses, again providing a potential transmission source.

“It is quite certain that no general conclusion can be drawn from an individual’s payment experience collected during a global pandemic.”

– says Endre Eölyüs, Mastercard’s Director for Hungary and Slovenia.

Since the invention of money, physical cash has always been king. The pandemic situation will certainly alter how most of the world pays for goods. For example, concerns about infection risks in public places such as supermarkets change consumer behaviour. Rather than several store visits with smaller transactions through the week, consumers now order a month’s supply of groceries to be delivered to their door. This has changed the nature of payment, away from physical cash to Internet based transactions, and in store using contactless technologies. Fortunately the burgeoning fintech industry has a myriad of technical innovations and assets to enable this shift in consumer behaviour.

Gergely Brückner interviewed the CEO of Cellum, János Kóka.

“Cash is bad for the society”

– says János Kóka, the president of Cellum. Cash is bad for societyfor many reasons. Its expensive to produce and difficult to transport and store. Plus, financial crime such as corruption and tax evasion would be difficult without cash. Finally, for health reasons, as it could spread infections before and after the current pandemic.

Although relatively unused within Hungary, smartphone payment services may soon be available. Cellum’s major marketplace, Indonesia has utilized smartphone-based payment services for some time. As Mr Kóka recalls;

“Most smartphones can used as a credit card for payment, or a credit card terminal for receiving payment”

Although credit or debit card use is relatively low in Indonesia, a high percentage of the population have access to a smartphone. Therefore, by enabling widespread access to payment apps and e-wallets, a consumer’s smartphone suddenly becomes a credit or debit card. From the e-wallet, money can be easily topped up onto a single-use credit card generated by the app and allows payment with a contactless terminal.

New payment options: the phone as a POS terminal

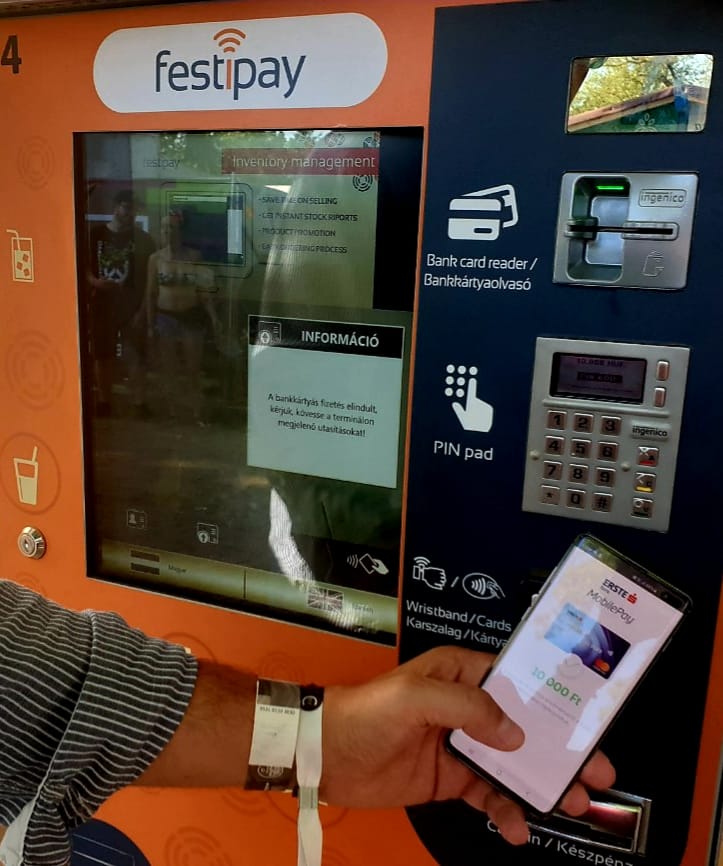

Cellum in conjunction with MasterCard and Festipay will soon launch a ground-breaking payment service in Hungary, allowing a smartphone to become a POS terminal. This enables a myriad of low-cost payment possibilities, and again only requires a smartphone with 4G connectivity.

The detailed testing of the new smartphone-based POS terminal is designed to exceed current fraud detection requirements. In Hungary and other countries, there could be many users and small businesses whose card transaction volume is too low to be accepted by banks. Additionally, leasing a traditional POS terminal could be too expensive. The forthcoming smartphone POS terminal will provide a low-cost method for small business to accept card-based payments, and therefore increase sales even during these turbulent times.

Proponents of digital payments say it is irrelevant how we pay, be it with instant transfer, card, mobile, e-wallet, or some trendy app. Everything, that is not cash has its benefits. However, during the pandemic contactless payments are the most relevant in this new era of payment options.

(Source: Index.hu)